A new tax package that ends exemptions and exceptions that do not contribute to the economy, mandates the purchase and sale of real estate at its real value, and introduces a minimum corporate tax for all companies is on its way! This comprehensive reform will be enacted into law before the summer holidays.

While the government aims to reduce the budget deficit through austerity measures, it will also take new steps to increase the budget’s revenue items, especially to combat informality and ensure tax justice. In this context, the finance bureaucracy has reviewed the exemptions and discounts in all tax legislation. Discounts, exemptions and exemptions that do not contribute to the economy were listed. According to the news of Türkiye Newspaper, the exemptions and exemptions in force under many headings ranging from corporate tax, income tax, VAT to title deed fees have been determined.

REGULATION ON CORPORATE TAX

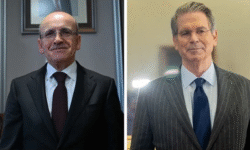

The practice of charging multinational companies minimum corporate tax, which was recently brought to the agenda by Treasury and Finance Minister Mehmet Şimşek, will also be included in the new tax package. In the new package, it is stated that a regulation will be made to ensure that the corporate tax to be paid by companies does not fall below 15 percent, even if they fall within the scope of incentives, exemptions or exemptions. A similar practice will also apply to domestic companies. In this context, a company will have to pay a minimum corporate tax even if it benefits from government incentives or tax exemptions.

THE STATE GIVES UP 2 TRILLION IN REVENUE

The scope of exemptions, exemptions and tax deductions has gradually expanded as new tax-exempt activities have been added each time. For example, there are around 30 areas of income that are exempt from corporate tax. In addition, the VAT Law includes dozens of exemptions, exemptions or deductions that apply only to the delivery of certain goods and services, certain transportation activities, cultural and educational activities and the purchase and sale of housing. According to some tax experts, due to these exemptions and deductions, the state forgoes 2 trillion liras of revenue.

TAXATION BASED ON REAL VALUE

Another study by the government will be on the purchase and sale of real estate and land at their real value. In a sense, the taxation of income from development rents or the sale of immovable properties at their real value will be on the agenda. For this purpose, a real estate value information center integrated with the Land Registry and Cadastre Information System will be established to keep data on the value of immovable properties and ownership information. Transactions in the land registry will be based on the information in this center and the appraisal report on the immovable.

DEFICIT TO FALL BELOW 5%

The year-end budget deficit is planned to be reduced below the targeted rate through cuts in public expenditures as part of austerity measures and new revenue-raising measures. The target for the ratio of budget deficit to national income was set at 6.4 percent this year. This ratio is planned to be reduced to around 5 percent at the end of the year by reducing expenditures, combating informality and other revenue-raising measures.

OVP TO BE UPDATED IN SEPTEMBER

AK Party sources said that the work of the Ministry of Finance will be brought to the agenda of the Parliament in a short time and that the updates in the tax legislation will be enacted with an omnibus bill to be prepared in the field of economy before the holiday. In addition to the austerity measures that have been put into practice, the reflections of the new tax package, the fight against informality and the amendments to be made in the tender legislation will be realized as of September.