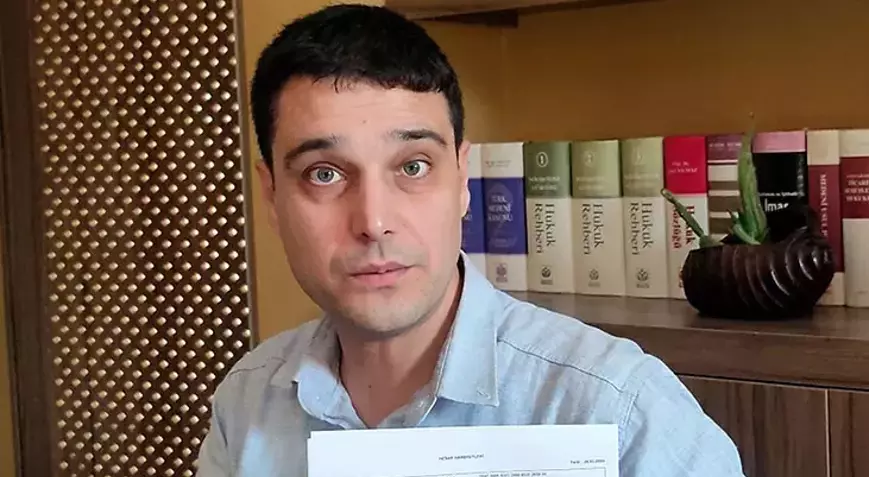

Uğur Kayalı (38), who lives in Muğla, filed a criminal complaint to the prosecutor’s office on the grounds that an account was opened in his name at a private bank he was not a customer of and a personal loan of 350 thousand TL was used without his consent.

Uğur Kayalı, an employee of Muğla Metropolitan Municipality Department of Transportation, who lives in Menteşe district, received a message on his mobile phone from a private bank at 01:51 on May 3: ‘Your personal loan of 350 thousand TL has been approved, your plus account has been defined and the loan has been insured’.

Kayalı contacted the bank’s customer services and stated that he was not a customer of the bank, had not applied for a personal loan and a surplus account and had not given any approval. However, the customer service representative stated that a mobile confirmation message was sent and that the transaction could not be canceled.

Kayalı filed a criminal complaint with the prosecutor’s office against both the bank and the person or persons who stole his credentials and opened an account in his name. Kayalı learned that 190 thousand TL of 350 thousand TL was transferred to another account via Electronic Fund Transfer (EFT), although he had the account blocked. Stating that he was victimized, Kayalı said, “The bank states that it is not responsible for the issue. An account was opened in my name and a loan was used from a bank I am not even a customer of. Although I had the accounts blocked, the money was transferred to third parties and from there to crypto accounts. I reached people who were victimized like me. We have a WhatsApp group of 150 victims. When I joined the group, there were 50 of us. I think there are many more people who have been victimized in this way. Even earthquake victims living in containers had accounts opened and loans taken out in their names. The security vulnerability of the banks is not eliminated in a way I do not understand. I am waiting for help from the authorities.”

‘SECURITY MEASURES NEED TO BE STEPPED UP’

Kayalı’s lawyer Şükriye Metin stated that her client was not only defrauded but also victimized by the bank and said, “The bank has set up an electronic system that allows citizens to take out loans over the phone. We all support the development of technology as long as it is used for good. However, if there are gaps in this electronic system established by the bank, if it allows the use of illegal or spyware software, if it makes transactions against the will of the citizen, then this system should be closed or security measures should be increased. In the current practice, the bank states that it has granted the loan and that the citizen should file a complaint against the fraudster and get his money back from him. This answer, which the bank gives and the system allows, leads the citizen from the defective electronic system into the legal system, which works too late. When the first installment of the loan arrives, the bank immediately notifies the citizen and starts enforcement proceedings if it is not paid. Even though the client did not do anything and did not even have a deposit account at the bank, the bank first created an asset that was not in his name, created a loan of 350 thousand liras, and then transferred this money to the accounts of third parties by the same bank. The bank, which did all this without obtaining the client’s actual approval, can demand this money from the client at the end of the process,” he said.

‘THE VICTIMIZED CLIENT BECOMES EVEN MORE VICTIMIZED’

Metin stated that his client filed a criminal complaint with the prosecutor’s office and said, “The prosecutor’s office can only find the guilty party and ensure that he is punished. However, in order for the loan debt not to be paid or the debt to be canceled, either a negative declaration lawsuit is filed or an enforcement action is taken. Both filing a lawsuit and enforcement proceedings are separate problems. If there is an enforcement proceeding, the debt of 350 thousand liras returns exponentially. If a lawsuit is filed, court costs have to be paid. If the client is considered a consumer and not a customer of this bank, he/she can file a lawsuit by paying a lump sum fee. However, if the consumer transaction is not accepted as a consumer transaction and is accepted as a tort, he has to pay at least 13-14 thousand liras for the money he was defrauded of 350 thousand liras and file a lawsuit. This causes the victimized client to be even more victimized.”

‘LEGAL ARRANGEMENTS SHOULD BE MADE URGENTLY’

Metin stated that the responsibility of banks in transactions made through the electronic system should be increased by introducing a legal regulation as a matter of urgency, and said, “Instead of citizens seeking their rights at the court gates, the bank should first prove that it has made a real contract, and it should not even be able to draw a floor notice to the citizen without being able to prove this. Considering the length of the proceedings, precautionary regulations should be introduced, and the bank, not the citizen, should pursue its receivables. For this reason, we demand that the necessary regulations be made urgently and the responsibilities of the banks be increased in order not to victimize more citizens.”

Source: DHA